Accounting firms in San Jose faces a range of challenges every day, both technical and otherwise. What are these challenges, and how should you try to overcome them?

Top 5 Challenges Accounting Firms Need To Overcome

Ae you struggling with the same obstacles over and over? You’re not alone. There are 5 key issues that accounting firms everywhere are putting up with – do you know what to do about them?

Accounting, just like every other profession, is affected by our ever-changing world. The increase in technological advances alone can leave your head spinning. Though technology is meant to make work easier for everyone, it requires your full attention to keep up.

However, technology is responsible for numerous positive changes in every field or industry. An accounting firm can get a lot more done each day with the professional software programs now available.

Many boring, repetitive jobs are accomplished with these programs and this allows accounting professionals to utilize their time on more important tasks.

Most of today’s accounting firms have embraced the changes that are occurring in our technology-driven world. And yet, many are undergoing dramatic changes that affect their business from various angles.

From cyber threats to rising costs, the accounting industry is facing its share of tough problems. Savvy business owners overcome these challenges and move forward. They turn these problems into stepping stones that lead to new opportunities.

Still, these issues can slow down the workflow and require too much attention. The struggle can be tiresome and never-ending.

What are the top 5 challenges to San Jose accounting firms?

1. Changing Taxes

The degree to which tax code continues to change makes it so difficult for accountants to keep up – but you still have to.

In order to serve clients, you need to be able to advise on their taxes, no matter how they change.

As noted by senior tax trainer Robyn Jacobson, “Most of the tax policy I’m seeing at the moment is in response to groups of taxpayers who are not complying,”.

“Sometimes there are only small groups of people in certain industries who are not complying, but the government will turn its attention to that entire industry. It’s like the old expression, ‘using a sledgehammer to crack open a walnut’.”

2. Meeting Deadlines

The combination of increasing change to the accounting industry and growing demand in the market means that deadlines are becoming more difficult to meet.

While there used to be downtime between one client and a next, that’s become more of a luxury. This is exacerbated by the fact that a modern workplace culture that often sees the day ending at 5:00 PM. Partners may have come up in an industry where long days (and nights) were the expectation, but new team members are more likely to cut out when their shift is done.

All of this contributes to heavier workloads and smaller windows in which to get it all done.

3. Growing & Sustaining

Given the difficulties with deadlines explored above, how can a San Jose accounting firm find time to focus on growth? If you’re too busy focusing on one client and then the next, how can you better focus on the big picture?

- Delegate the non-critical aspects of your work to your team (or better yet, drop them altogether) and invest your time in innovation and new clientele.

- Communicate changes to your workflow with your clients (and how they may affect them). If you’ll have less time to chat one-one with your clients because you’re focused on serving them better, make sure they understand that.

- Bring your team in from the ground up on cultural and holistic changes you’re making to the firm. Make them a part of the conversation so that they can engage with what you’re doing and help affect real change.

4. Adopting New Advancing Technology

Perhaps most important challenge that accounting firms face is the constant need to update their technology.

You want to have the latest and greatest software programs and network services, but all this can be expensive. To make matters worse, technology is constantly evolving. Today’s smartphones offer advanced features you couldn’t get a year ago.

For many firms, the best way to alleviate this concern is to find an San Jose IT company and allow them to handle the technical aspects of your accounting firm’s operations.

5. Engaging Clients With New Technology

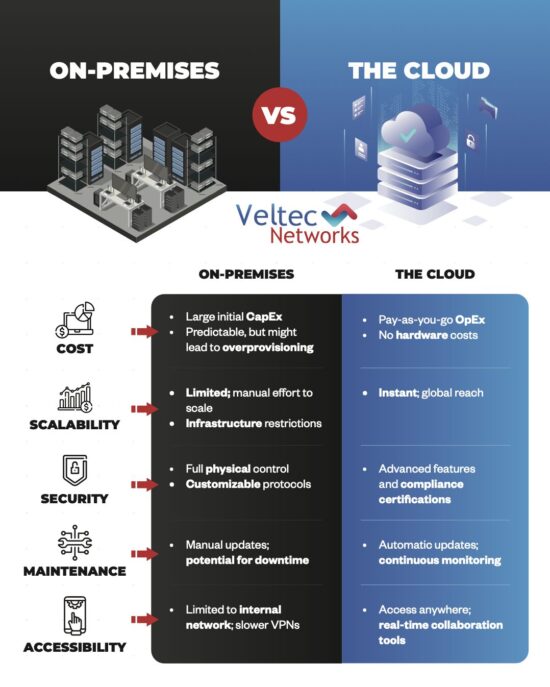

The other side of that coin is making sure your clients understand what changes to your IT will mean for them. If their data is being moved to the cloud, they need to know what sort of benefit that can provide, as well as be assured that it won’t have any downsides.

Remember, improving your IT (either through independent upgrades or with the help of a San Jose IT company) is an opportunity to share with your clients. It’s a sign you’re growing organizationally and moving forward – don’t breeze past it!

The good news is that IT companies in San Jose can help with a number of these challenges. Meeting deadlines, adopting new technology, providing staff- and client-facing benefits… IT intersects with all of these.

It’s just a matter of finding the right San Jose IT company.

So, what’s the secret?

The truth here is very simple; it’s not a ten-point list, or a comprehensive, complicated strategy. The one thing to look for in IT services for accounting firms in San Jose is a team that understands the accounting industry and the technology involved in it.

Accounting firms need to be assured that they will be the priority for their IT support provider during the tax season, simple as that. No addendums or clauses or clarifications. When they call, their San Jose IT company needs to answer them and address the issue.

Similarly, and particularly for accounting firms in San Jose, their IT company should account for the fact that the firm’s Internet connection needs to be strong enough to support a cloud environment.

That means it can’t be a generic, one-size-fits-all cloud configuration, but rather, a robust set-up that will meet the firm’s needs throughout their busy season.

By partnering with a San Jose IT company that understands an accounting firm’s work, schedule, and priorities, you can ensure a smooth tax season that won’t be plagued by downtime and delays.

Like this article? Check out the following blog on the accounting industry to learn more: